Bookkeeping Outsourcing Services Provider Bookkeeping Services QXAS USA

Content

Receive monthly reconciliation updates and get back the time you would have spent during month-end close. Your bookkeeping procedures need to be standard to ensure consistency. We ensure this by having written procedures to ensure the basic principles are never compromised.

Our outsourced bookkeeping services include budgeting and forecasting. By giving us essential information such as budget, expenses, liabilities, and upcoming goals, our accounting staff can map out a realistic financial plan for your business. Many outsourced bookkeeping services are more cost effective than paying a full-time bookkeeper’s salary plus benefits. Are you tired of spending your free time reconciling your books, but don’t want to spend a small fortune hiring an expensive full-time CFO or controller? We are the outsourced bookkeeping service that provides your business with accurate and timely back office functions, from basic project management to complex strategic planning.

Now what do these collaborative outsourced bookkeeping services typically cost?

We invite you to outsource your accounting and bookkeeping services with PorterKinney. Many small business owners can save time and money by outsourcing their accounting and bookkeeping services to our firm.

With a steady stream of resources that are deployed by the outsourcing company, you can assign other tasks to your in-house team to maximize the level of productivity. Hiring a qualified accountant can add significantly to the budget of a company and can be lowered when you have an array of services that are managed by us. Our process will keep record of any financial transactions which takes place in your business. Not to mention that accurate services will ensure that you will NOT get in trouble with any federal agencies due to the mistakes in your reporting. We understand that hiring accountants can be as expensive as an outsourcing agent. Before choosing to outsource accounting, study the flexibility level of the providers. If you have a team or a responsible person managing the accounting tasks right now, discuss with them what needs to be outsourced.

Reasons to Use an Outsourced Bookkeeping Service

You even get access to our in-house tax professionals, who can advise you on minimizing your tax bill. BooXkeeping offers outsourced bookkeeping services that can eliminate the burden of tracking expenses and keeping your financial records organized.

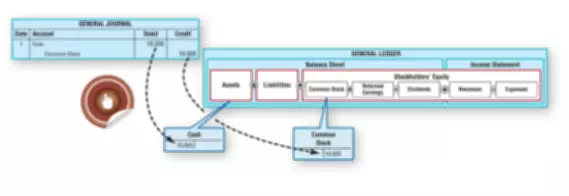

You’ll get more thorough financial documents and accrual-basis accounting with KPMG Spark’s more expensive plans, starting with the Professional plan at $795 a month. Come tax time, an online bookkeeping service may also give you a year-end financial package, which contains all of the financial statements your accountant will need to file your small business tax return. A key to a successful business is to keep track of the numbers to see what parts of the business are working and what needs improvement. Supporting Strategies ensures all transactions are accurately captured in the books. In our month-end close and review process, we make necessary journal entry adjustments, reconcile balance sheet accounts and verify accuracy of income statements. We also support additional categorization, such as class or project accounting. An outsourced bookkeeping service may be able to assist you with your year-end financial filing.

Accounting Firms

One of the most obvious benefits of outsourcing accounting bookkeeping services is that you save on payroll and operational outsourced bookkeeping services costs. Bookkeeping helps you get answers to pressing operational questions surrounding your business.

When should I outsource bookkeeping?

It’s never too early to consider outsourcing your bookkeeping. Bookkeepers may be able to help you track and take advantage of common tax deductions, managing sales and use tax, and even running your payroll. Some bookkeepers may also handle bill payments or manage your receivables.