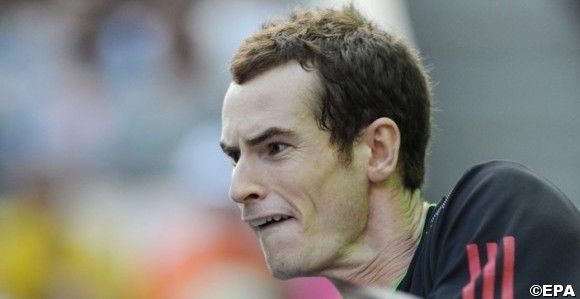

Murray’s Sponsor Seeing Profits Drop

The bank that bankrolls Andy Murray has taken a big financial hit in its latest numbers. The outlook Royal Bank of Scotland, which suffered badly in the through the first round of the global financial crisis in 2008 seems to have only gotten worse, with the Murray money handlers turning in another poor performance for the market.

Officials reported that RBS profits dived 63 percent in the 2011 third quarter at Britain’s biggest bank to total $428 million instead of a nearly $150 million more which had been anticipated by the markets.

The current loss may not bode well for the personal contract the Scottish world No. 3 holds with the bank. Murray, who previous contract was said to be $3.2 million per year, received an extension last summer. He also survived a round of cuts in sponsorship in 2009, which saw RBS cut back on motor racing and other sporting activities after spending $320 million per annum on them in the good old days.

RBS almost went to the wall in 2008, receiving the largest bailout in British history totaling $72 billion. Now the government fears that another cash infusion might be looming. If so, then the Murray sponsorship might truly come well down the list of burning priorities.

If RBS were to pull the plug down the road – the British economy is certainly not looking chipper and cheerful these gloomy days – Murray would be unlikely to feel the pain in his Surrey mansion south of London.

The 24-year-old has topped $17 million in prize money, helped in no small part by his three title paydays last month in Asia, where he won three events in as many weeks including the Shanghai Masters to collect in excess of $1 million (before tax) in October.

“DAILY TENNIS NEWS WIRE”

10sBalls Top Stories

- Bahis Sitelerinin Deneme Bonusu Kullanım Şartları

- Deneme Bonusları ile Ücretsiz Bahis Nasıl Yapılır?

- Cazip Hoş Geldin Bonusları ile Üyelik Avantajları

- Bahis Siteleri ve İlk Üyelik Bonusu Detayları

- Yeni Üyeler İçin En Cazip Bahis Bonusu

- Deneme Bonusları İle Eğlenceli Oyun Deneyimleri

- Güvenilir Bahis Siteleri: Bonus ve Güvenlik İncelemesi

- Reasons Behind the Increase in Sex Shops

- Reasons Behind the Increase in Sex Shops

- Reasons Behind the Increase in Sex Shops

- Casibom: Yaşayan Casinolar ve Bahisler Lider Platform

- Sea Star Casino: Play Games Without Registering Online

- JETZT DEN SWEET BONANZA SLOT GRATIS DREHEN

- Азартные игры с Мостбет Казино – испытайте удачу

- Çevrimiçi en iyi yuvalar: Hizmetinizde Karavan Bet Casino

Murray’s Sponsor Seeing Profits Drop

Murray’s Sponsor Seeing Profits Drop